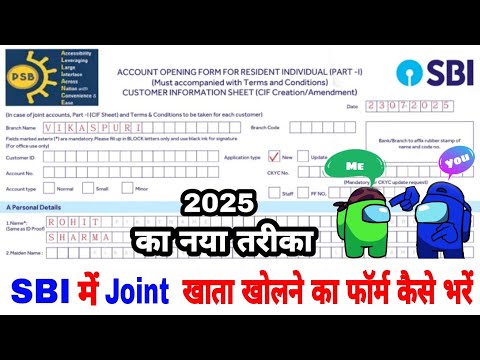

🏦 SBI Joint Account Opening Form Kaise Bhare – Step by Step Guide (Hinglish Mein)

🏦 SBI Joint Account Opening Form Kaise Bhare – Step by Step Guide

Agar aap State Bank of India

(SBI) mein joint account kholna chahte ho, to sabse pehle aapko ek Joint

Account Opening Form bharna padta hai. Yeh form kaafi detailed hota hai,

isiliye aaj ke blog mein hum step by step har ek section ko samjhenge Hinglish

mein, taaki aap form galti ke bina fill kar sako.

🔹 Part 1 – Branch Details

& Account Type

📌 Branch Name aur Code

- Yahan aapko us SBI branch ka naam aur branch code

likhna hoga jahan aap account open karna chahte ho.

- Example:

SBI, Tilak Nagar Branch, Delhi – Code: 12345

📌 Account Type

- Tick

karo kis type ka account chahiye:

- ✅

Saving Account (normal personal use)

- ✅

Current Account (business ke liye)

- ✅

Joint Account – “Jointly” ya “Either or Survivor” select karo.

📌 Note: "Either or

Survivor" ka matlab hai ki dono account holders mein se koi bhi operate

kar sakta hai.

🔹 Part 2 – Applicant

Details (1st Applicant)

🧑💼 Personal

Details

- Full

Name (as per Aadhaar or PAN)

- Father’s/Husband’s

Name

- Date

of Birth

- Gender

- Nationality

- Marital

Status

🏠 Address

- Permanent

Address (Aadhaar se match hona chahiye)

- Correspondence

Address (agar alag hai to likho)

📞 Contact Details

- Mobile

Number (Active hona chahiye)

- Email

ID (for e-statements and alerts k liye)

🔹 Part 3 – KYC Documents

(1st Applicant)

- ✅

Identity Proof (PAN Card)

- ✅

Address Proof (Aadhaar Card, Voter ID, Passport)

- Dono

documents ka photocopy attach karo + originals leke jao verification ke

liye.

🔹 Part 4 – Second

Applicant (Joint Holder)

Second person ke liye bhi same details bharni hoti hain:

- Full

Name, DOB, Gender, Relationship with 1st applicant

- PAN,

Aadhaar, Address, Mobile Number, Email ID

- KYC

documents photocopy + originals

📌 Tip: Dono applicants ke

signature ek jaise boxes mein hone chahiye jahan form mein bola gaya ho.

🔹 Part 5 – Mode of

Operation

- Select

karo:

- Either

or Survivor

- Jointly

- Former

or Survivor

Most common option hai “Either or Survivor” – jisme dono

mein se koi bhi account operate kar sakta hai independently.

🔹 Part 6 – Nomination

- Aap

kisi ek nominee ka naam likh sakte ho jise account holder ke death ke baad

paisa milega.

- Nominee

ka:

- Naam

- Relationship

- DOB

(agar minor hai to guardian details bhi)

🔹 Part 7 – Declaration

& Signature

- Dono

applicants ko form ke end mein declaration padhkar sign karna hota hai.

- Signature

bank ke record ke liye hota hai – form ke saath hi ek “Specimen Signature

Card” bhi fill karwaya jaata hai.

🔹 Part 8 – Passport Size

Photos

- Dono

applicants ke recent passport size photos lagane hote hain.

- Bank

pe jab jaoge, wahan pe form ke samne live photo le sakte hain verification

ke liye.

🏦 SBI Joint Account

Opening Process – Step by Step

- Form

ko ghar par ya branch se leke acche se fill karo.

- Required

KYC documents attach karo.

- Nomination

details sahi se fill karo.

- Dono

applicants ke signature sahi jagah par karo.

- Form

submit karo nearest SBI branch mein.

- Bank

officer documents verify karega aur account open kar dega.

- Aapko

passbook, cheque book aur ATM card issue kiya jayega.

✅ Important Tips

- PAN

card sabhi applicants ke liye mandatory hai.

- Signature

bank ke record ke liye clear aur consistent hone chahiye.

- Address

proof aur identity proof same document bhi ho sakta hai (like Aadhaar).

- Agar

kisi ka naam mismatch ho documents mein, to correction affidavit lag sakta

hai.

📌 Conclusion

Joint account kaafi helpful hota hai jab aap kisi family

member, spouse, ya business partner ke saath account operate karna chahte ho.

Upar diya gaya guide aapko step-by-step samjhayega ki SBI joint account opening

form kaise bharein bina kisi confusion ke.

© 2025 Banking with GPK. All rights reserved.

Disclaimer: Yeh blog post sirf general information ke liye hai. Isme diye gaye details official bank policies ke anuroop hone ki koshish ki gayi hai, par exact process ke liye hamesha apne najdeeki SBI branch se contact karein. Hum kisi bhi nuksan ke liye zimmedar nahi hain jo is post ko follow karne par ho sakta hai.

.png)

Comments

Post a Comment