🧾 SBI KYC Form Kaise Bharein, KYC Process Kya Hai Aur Regular KYC Karne Ke Fayde

🧾 SBI KYC Form Kaise Bharein, KYC Process Kya Hai Aur Regular KYC Karne Ke Fayde

🔍 KYC Kya Hota Hai?

KYC ka full form hota hai Know

Your Customer. Ye ek process hai jisme bank ya financial institution aapke

identity aur address ko verify karta hai. Ye step zaroori hai taaki aapke

account ka misuse na ho aur aap banking facilities ka safe tarike se use kar

sakein.

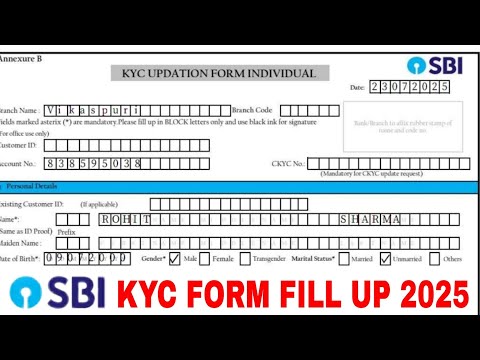

📝 SBI KYC Form Kaise

Bharein? (Step-by-Step)

Step 1: SBI KYC Form Download Karein ya Branch Se Lein

Aap SBI ki official website se

KYC form download kar sakte hain ya apne nearest branch se le sakte hain.

Step 2: Personal Details Bharein

Form me aapko ye details bharni hoti hain:

- Account

Holder Ka Naam

- Account

Number

- Customer

ID (CIF Number)

- Mobile

Number

- PAN

Number (Agar hai to)

- Aadhaar

Number (Optional but recommended)

Step 3: Address Proof Details

Aapko apna present address aur permanent

address likhna hota hai. Agar dono same hain to same likhein.

Step 4: Identity Proof Lagayein

Form ke sath valid documents attach karna zaroori hai:

- Aadhaar

Card

- PAN

Card

- Voter

ID

- Passport

- Driving

License (valid one)

Step 5: Self-Attestation Zaroori Hai

Sabhi documents par apne signature ke sath “self-attested” likhna na bhoolen.

Step 6: Recent Passport Size Photo Chipkayein

Form me photo chipkana mandatory hai.

Step 7: Signature Aur Date

Form ke end me aapko apna signature aur form bharne ki date likhni hoti hai.

🏦 SBI KYC Process Kaise

Hota Hai?

- Form

Submit Karein: Bharahua KYC form aur documents SBI branch me jama

karein.

- Verification:

Branch staff aapke documents verify karega.

- System

Update: Aapke account me updated details enter ki jaayengi.

- Confirmation:

Verification ke baad aapko SMS ya email ke through confirmation milta hai.

✅ Regular KYC Karne Ke Fayde

- Account

Block Hone Se Bachaav

Agar aapka KYC

outdated hai to account freeze ho sakta hai. Regular update se ye problem nahi

aati.

- Secure

Banking Experience

KYC se aapke

account ka unauthorized use rok sakte hain. Fraud ke chances kam hote hain.

- All

Services Access

KYC updated hone par aapko internet banking, mobile banking, loan, aur other facilities bina rukawat ke milti hain. - Regulatory

Compliance

RBI ke rules ke according har customer ko updated KYC dena mandatory hai.

📌 Important Tips

- Form

hamesha black or blue pen se

bharein.

- Spelling

mistakes avoid karein.

- Documents

clear photocopy hone chahiye.

- Signature form aur documents dono par match hona chahiye.

🔚 Conclusion

SBI KYC form bharna ek simple aur

important process hai jo aapko secure aur smooth banking ka experience deta

hai. Agar aapne abhi tak apna KYC update nahi kiya hai, to aaj hi branch visit

karein aur ye process complete karein.

Aapka account safe, active aur

future-ready bana rahe — ye aapke regular KYC se possible hai!

Related Articles

👉 SBI me naya account kaise kholein? Pura form bharne ka tarika yahan dekhein.

👉 SBI Joint Account Opening Form Kaise Bhare? Step by step process is post me padhein.

👉 Union-bank-account-opening-form-guide? Yahan se lein.

.png)

Comments

Post a Comment